Three years ago, on this very day, we set out on a mission to revolutionize digital asset wallets and custody for institutions. While we began our journey with the development of self-custodial wallets, guided by the principle of ‘not your keys, not your coins, ’ we have slowly and steadily progressed towards our goal of building a robust custody platform that serves institutions of all sizes. This commitment to empowering institutions to secure their digital assets remains at the core of our technology and operations.

Our journey has been exceptionally eventful since the time we started. On the one hand, we can clearly see the shift brought about by adoption of more and more institutions seeking a less onerous approach to managing wallets. On the other hand, the digital assets ecosystem and the regulatory landscape continued to see massive shifts like the FTX crash or the numerous hacks and scams, with billions of dollars in digital assets being compromised. By this time, it was clear that the digital assets ecosystem would require frameworks to implement robust security, compliance, and key management practices. Owing to our institution-grade security and compliance standards, we were always best placed to provide digital asset custody services to accommodate this growing demand standard.

As we stand today, celebrating our third anniversary, we invite you to take a walk down memory lane and witness what we have achieved in the past year

Unlock the potential of digital assets for your institution

Liminal Launched New Stack Of Products

Last year was the most intensive one for our product builds as we launched a bunch of new functionalities to facilitate institutions with an array of features under the same roof. We integrated fund deployment opportunities, risk and compliance monitoring automation, whitelabel for hot and cold wallets, and fully managed custody to strengthen our product suite and enable institutions to pick and choose how they wish to optimize, utilize and secure their assets with Liminal.

- Institutional Staking: We partnered with industry-leading institutional staking provider Figment to integrate cold-wallet staking so our clients can access secure PoS staking. This is perfect for institutions looking to put their secure funds to use and earn passive income without comprising the assets.

- Whitelabel Custody: We replicated our wallet infrastructure and put it into a whitelabel solution for those institutions looking to deploy it within their own brand name. With the help of our easy-to-build framework, developing a robust hot and cold wallet custody solution with full backend support and a fully custom frontend is super easy.

- Liminal Firewall: With the growing instances of risk and compliance complications for institutional transactions, we created a firewall engine that works on an automated workflow principle to track and monitor each transaction for risk anomalies and compliance checks before sending it through for signing, reducing the chance of loss of funds due to poor and manual risk management.

- Institutional Custody: Our most anticipated launch happened when we officially launched our managed custody service at the start of this year. To help institutions mitigate unique challenges while managing digital assets, from securing private keys to navigating complex compliance regulations, we introduced a cold-wallet managed custody platform, one with best-in-class security protocols, segregated accounts with no rehypothecation of assets, firewall engine plug-in for automated compliance checks, customizable governance policies and concierge service with industry-leading SLAs to power institutions with secure, compliant, insured, bank-grade custody.

Secure and manage your digital assets with Liminal

This past year was a landmark for us, releasing such a rick-stack of products, and this is just the beginning. Our next set of product releases will perfectly complement our existing wallet infrastructure and digital asset custody solutions, such as node-as-a-service, insurance-as-a-service, off-exchange settlement, hot wallet custody, and more.

Business Numbers

We’re thrilled to share the exponential growth in our primary business numbers that represent actual growth, assets under protection (AUP), and the total volume of transactions processed through our secure hot and cold wallet infrastructure.

These growing numbers are a testament to two key factors:

- Client Trust: It showcases our partners are increasingly choosing Liminal as their go-to infrastructure to safeguard their valuable digital assets. The surge in our AUP number signifies their confidence in our product agility and operational excellence.

- Platform Efficiency: Our streamlined custody solutions facilitate high volume of transactions with seamless execution, low gas fees, and near-to-zero failures. The hike in transactions processed translates to significant benefits for our clients while making faster and more efficient transactions.

Security Updates

As an organization, we have always built our infrastructure around the best, most updated, and leading security parameters to keep our clients’ wallets, assets, and keys safe from all types of risks and threats, internal and external.

- We achieved SOC2 Type 2 (a gold standard of information security globally) within 1.5 years of establishment

- We became 2nd CCSS-certified organization globally

- We achieved ISO 27001 AND 27701 within the first 8 months

- We started a 24*7 Security Operations Centre to monitor audit events and transactions

Last year was no different as we proactively upgraded our security audits, upgraded our certifications to comply with key security frameworks.

Furthermore, we took our security obsession one step further by partnering with Confide to launch a CCSS-certified program exclusively for institutions with major digital assets exposure to become a CCSS-certified platform.

Custody Licenses

Our stride to add the custodian badge and become a qualified custodian under the name Liminal began initially, but it came true last year. After a strenuous process of meeting the requisites to apply as a custodian across major jurisdictions, we received the first accreditation in the MENA region.

We acquired an IPA from FSRA for an FSP license to operate as a certified third-party digital asset custodian in the ADGM region. The fully approved license is expected to arrive in Q2 of 2024, which will allow Liminal Custody to spread its reach in the most progressive and regulatory-clear region for digital assets.

New Offices

We stepped up our expansion plan last year to open new offices and set up shops in jurisdictions with a clear stance on promoting digital assets, supporting institutions, and working towards implementing regulations.

We opened a new office in Abu Dhabi with a new entity and new crew to kickstart our FSP license journey. Our second office opened in India with the vision of serving our existing Indian clients better and actively applying for FIU licenses in India.

Team Growth

Everything that we have achieved throughout this journey has been and for the past year has only been possible with our ever-growing team of Liminalites, which is now 80+. Our new team members include a whole new compliance team, our new CEO for the Abu Dhabi entity, a lead MPC scientist, and more.

With our growing strides, we are continuously hiring new team members to break the barriers to innovation in digital asset management, security, and compliance and curate the best digital asset custody experience.

Network Associations

As we’ve crafted robust wallet and custody solutions tailored for institutions, forging strong ecosystem connections has remained paramount. Throughout our journey, we’ve cultivated deep partnerships with prominent crypto communities worldwide, making it easier for institutions in the digital asset and Web3 space. We onboarded over 100+ partners across categories to spearhead the partnerships program.

Over the past year, we’ve teamed up with renowned communities such as ABI Indonesia, Crypto Oasis, Crypto Valley, Crypto UK, and BWA to strengthen our presence across Southeast Asia, MENA, Europe, and India. These partnerships have enabled us to reach more institutions and educate them on industry-standard practices for secure asset custody.

Additionally, we’ve forged a commercial partnership with Ripple to provide established blockchain protocols, facilitating the creation of native infrastructure for web3-focused organizations. This collaboration ensures safe custody and compliant operations from the ground up.

Liminal Rebranding

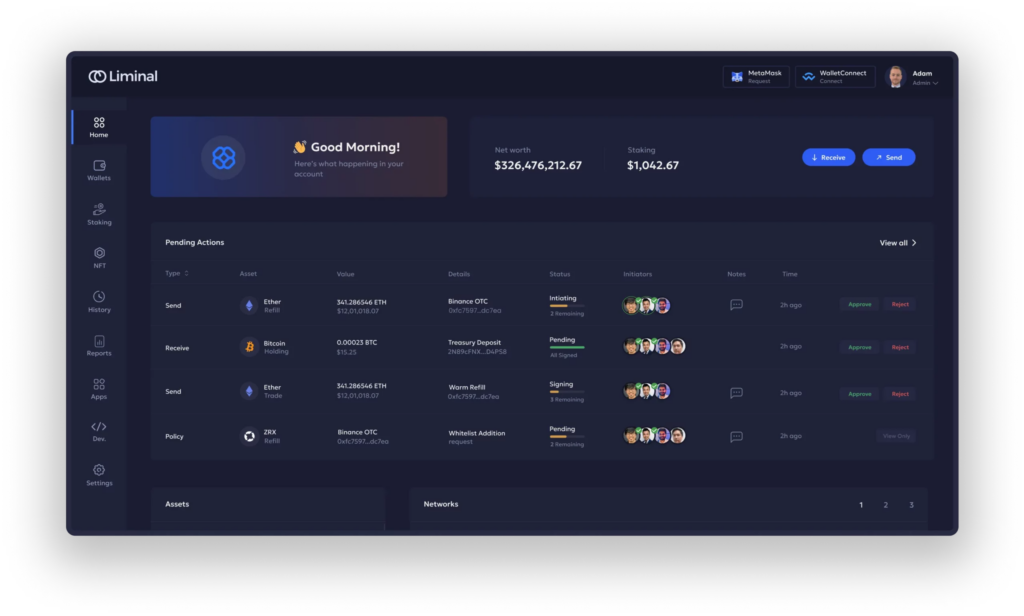

Out of all the amazing initiatives we took up last year, we picked up a complete re-design project to change the entire look and feel of Liminal as a brand.

This upgrade involved a complete overhaul of our website and product user interface (UI), transforming not just Liminal Custody into a whole new experience. With this re-design, we have elevated our brand value and delivered an intuitive, welcoming, and customized experience for our clients.

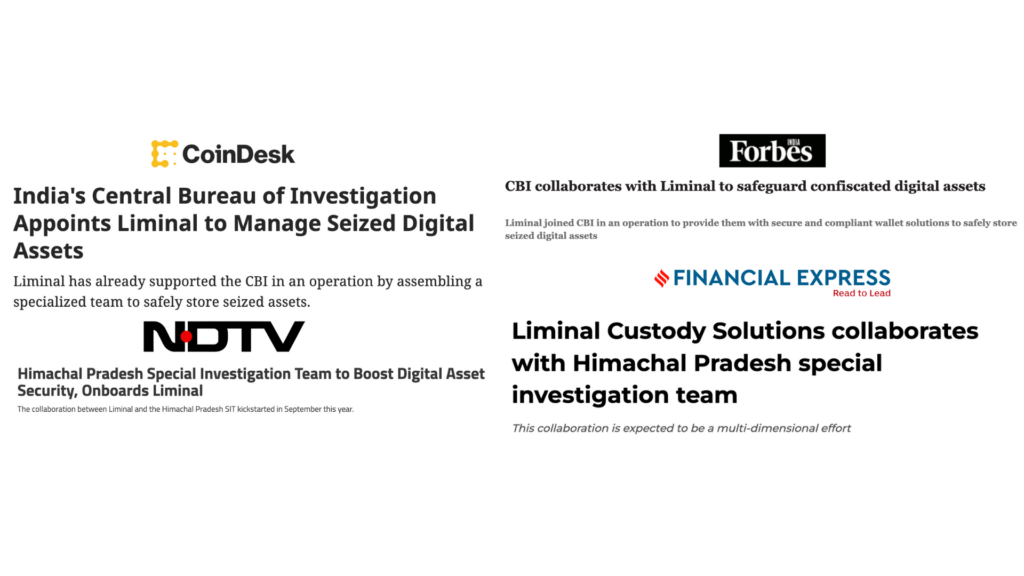

Collaborated with Law Enforcement

This year, Liminal reached a significant milestone by partnering with the Central Bureau of Investigation (CBI) and the Himachal Pradesh police department to assist in the seizure of digital assets. This collaboration elevated our reputation and positioned us as the primary contact for Law Enforcement Agencies (LEAs) in India.

We standardized the process for securely seizing digital assets, leveraging our expertise to create a safe environment for officers to learn custody basics. By doing so, we’ve played a pivotal role in fostering a safer digital landscape.

What Liminal Is Aspiring in its Fourth Year?

Our journey has always been about creating the highest standards of security, compliance, automation, governance, and support for institutions struggling to manage their digital assets.

And we have constantly evolved our arsenal to build a product-agnostic approach. From self-custody wallet infrastructure, we now enable institutions to opt for a more dynamic and hybrid infrastructure of cold wallet managed custody and hot wallet self-custody.

This year, we have set even bigger goals to achieve. We aspire to become the first CCSS-certified, regulated, and qualified custodian, deliver the latest compliance integrations built right into our custodial and non-custodial wallets, add powerful automation to eliminate manual redundancies in wallet management, offer institutions with full flexibility to alter their governance settings and offer 24*7 support for our partners.