As the bounds of the digital asset have grown irrevocably and the technical know-how of keeping secure custody, following the compliance and regulations, building a unified access board for differentiated wallet types and elaborating maximal potential out of withholding asset inventory has changed its definitions and measures, the role of wallet and custody providers has expanded explicitly.

When we started our journey to become a bespoke wallet infrastructure platform, we seldom knew that in a short period, we would go out to achieve incredible milestones and establish ourselves as one of the fastest-growing digital asset custodians and wallet service providers in the APAC and MENA region.

As we enter our 3rd-year of operations, here’s a full round-up of how we started and where we wrapped our 2nd.

Unlock the potential of digital assets for your institution

The Initiation

How Liminal Initiated is a classic story of need turned into ideation turned into reality. Our Founder, Mahin Gupta, leading one of the biggest crypto exchanges in India, found a disconnect between the existing custodians and wallet providers in their exclusivity of offerings and innovation to help mature the digital assets security market.

Mahin Gupta, Founder of Liminal

This realization led to him leaving the legacy of building exchanges behind and get onto a new mission of reconciliation of the value proposition of self-custody and how web3-powered institutions and enterprises approach compliance and regulated-friendly way of handling their assets.

Liminal was the brainchild to recourse the problem of wallet vulnerabilities, unnecessary expenses, high-volume asset management, money embezzlement through digital assets and errors associated with transaction processing.

Secure and manage your digital assets with Liminal

Expanding Product Line-Up

The product roadmap of Liminal was iterated as we grew and comprehended the needs and demands between urging markets and clients.

The immediate viability of solving self-custody wallet problems grew soon to build automation, Multi-Sig, MPC, workflow customization, gas fee saver algorithms, and transaction guarantee policy engine functionality.

And this tradition continues to grow as we prepare for our 2nd anniversary with Institutionalized Staking launching soon.

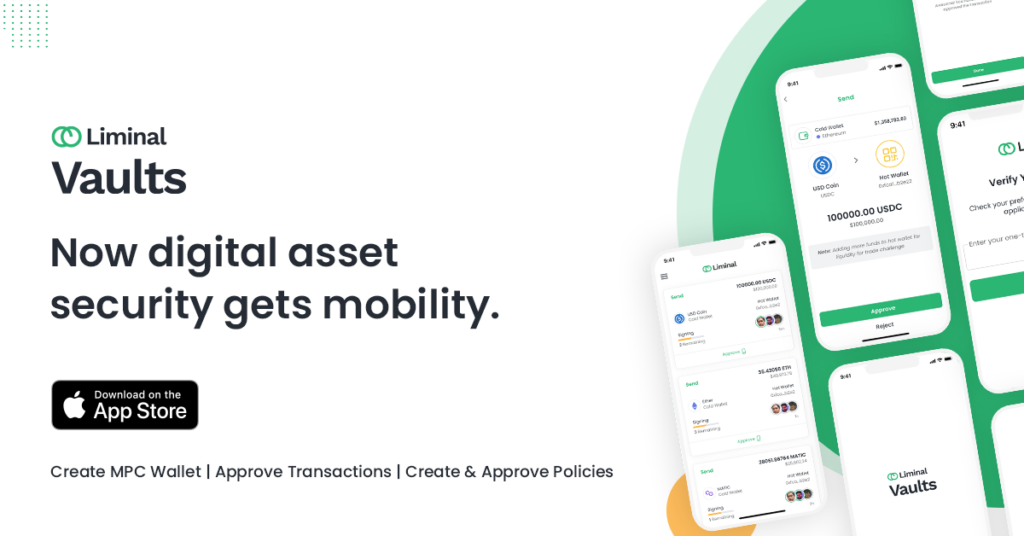

Liminal Vaults App now Live on App Store

Transaction Volume Surpassing $5.5 Billion

Working with over 40+ businesses operating in the domain of digital asset support applications, we have crossed substantial figures that mark our inception of market dominance.

● Assets Under Protection – $500+ million

● Transaction Volume – $5.5+ Billion

● Manual Hours Saved – 800+ hours

● Wallet Refills Processed – $550+ Million

Highest Standards Of Regulations and Compliance

We have acquired industry-standard security certifications and adherence to compliance guidelines in different jurisdictions.

Our list includes ISO, SOC2 certifications and only the second CCSS Level 3 QSP. We are also on the cusp of completing two more regulatory licenses to enable us to operate in new markets and expand our offerings.

Liminal’s Seal of Security

New Offices In Singapore and Hong Kong

With APAC being our key demography, we took the first step in extending our services from 2 key locations; Singapore and Hong Kong.

Our offices are now in place with local teams working diligently with Web3 native teams to help them resolve distinctive problems in maintaining custody and how to grow the valuation of their assets sustainably.

Liminal’s Office in Hong Kong

A Dynamic Team of 50+ Members

Our two-to-infinity journey has taken giant leaps all because of the fantastic team behind the curtain, creating protocols, renovating technologies, providing the utmost catered customer experience and leading the cause of decentralized custody of assets.

With diverse backgrounds, varied experiences and audacious goals, we all have but one passion, to build Liminal as the epicentre of wallet and custody infrastructure solutions.